Have you ever wondered why certain stocks skyrocket while others plummet? Or why one brand suddenly becomes the talk of the town, while another fades into obscurity? Much of this can be traced back to market sentiment. But what exactly is market sentiment? Simply put, it refers to the overall attitude or feeling that investors, consumers, and the general public have towards a particular market, brand, or economic condition. Understanding market sentiment data is crucial for businesses and investors alike. It’s like having a direct line to the heartbeat of public opinion. Whether you’re launching a new product or deciding when to buy or sell a stock, knowing what people think and feel can be a game-changer.

Understanding Market Sentiment Data

So, how do we capture this sentiment? Enter market sentiment data—the information and insights derived from analyzing public opinion. But not all sentiment data is created equal. It comes in two forms:

- Qualitative data: Think social media posts, news articles, and blog comments. These are subjective opinions, but they hold valuable insights.

- Quantitative data: This is numerical data, like polls or surveys, that give a measurable sense of how the public feels.

Together, these types of data provide a comprehensive picture of the market mood.

Types of Market Sentiment

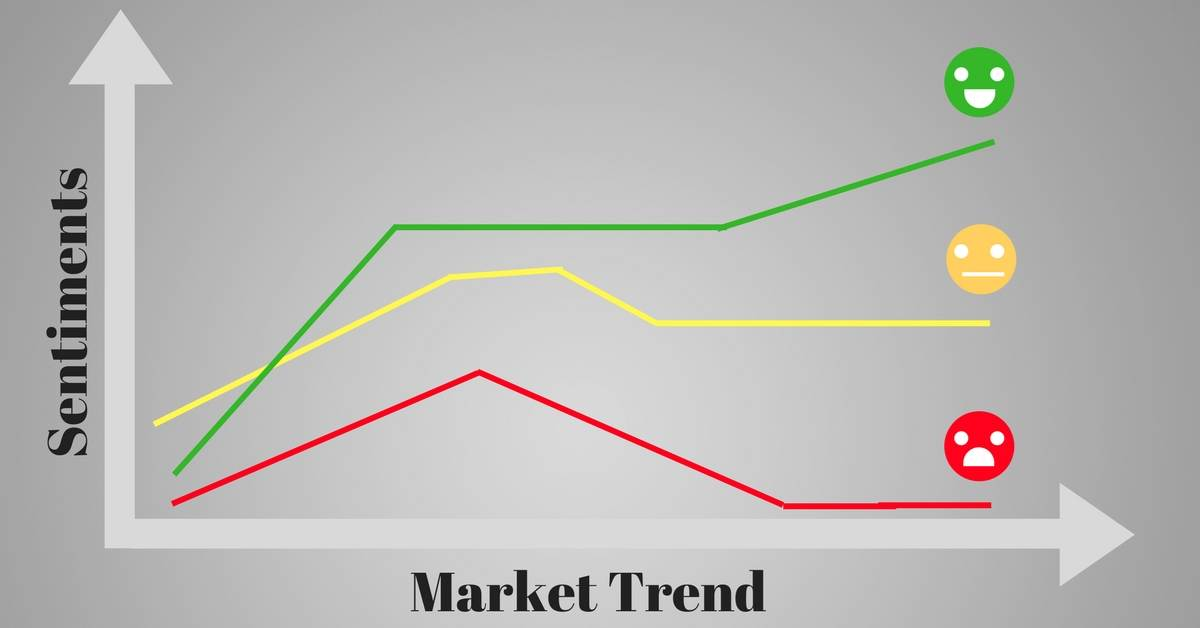

Market sentiment typically falls into three categories:

- Bullish sentiment: Optimism is high, and people believe that prices or markets will rise.

- Bearish sentiment: On the flip side, pessimism reigns, and people expect a market downturn.

- Neutral sentiment: The jury’s still out, and there’s no strong opinion either way.

Understanding these sentiments can help you navigate market waters more confidently, whether you’re an investor or a brand strategist.

How is Market Sentiment Data Collected?

Collecting market sentiment data is no small task. It involves gathering opinions from various sources:

- Social media platforms: Twitter, Facebook, and Reddit are gold mines for real-time opinions.

- News and media outlets: Journalists and media companies often shape public perception.

- Financial reports and earnings calls: Corporate transparency offers insight into investor confidence.

- Surveys and polls: These provide direct feedback from the public.

Together, these sources create a multi-faceted view of how people feel about markets or brands.

Tools for Analyzing Market Sentiment Data

You might be wondering, “How do we make sense of all this data?” Luckily, there are plenty of tools to help:

- Social listening tools: These monitor mentions of your brand or stock across social platforms.

- AI-driven sentiment analysis software: AI can analyze large volumes of text and detect sentiment with incredible accuracy.

- Media monitoring platforms: These track mentions of your company in news articles, blogs, and press releases.

Applications

For businesses, sentiment data can provide valuable insights into market trends, helping to:

- Identify market trends: Understanding public sentiment can alert you to shifts in consumer behavior or market conditions.

- Influence business decisions: Should you launch that new product now, or wait until market sentiment improves? Sentiment data can guide you.

- Shape marketing strategies: Knowing how people feel about your brand can help you tailor campaigns to boost positive sentiment.

Applications

Investors use sentiment data to:

- Predict stock market movements: Bullish sentiment often precedes a rise in stock prices, while bearish sentiment can signal a downturn.

- Evaluate company reputation: If sentiment is high, it’s a good sign that a company’s future looks bright.

- Spot market opportunities: Sentiment data can help investors identify undervalued stocks or emerging market trends.

Challenges

While sentiment data is valuable, it’s not without its challenges:

- Data accuracy and reliability: Not all opinions are genuine. Fake news, bots, and trolls can skew data.

- Handling large volumes of data: With so much information to process, it’s easy to miss critical insights.

- Interpreting mixed sentiments: People can have mixed feelings about a market or brand, making it harder to draw definitive conclusions.

How Market Sentiment Impacts Consumer Behavior

Sentiment data isn’t just for investors. It also plays a key role in shaping consumer behavior. When people feel positively about a brand or product, they’re more likely to make a purchase. On the flip side, negative sentiment can drive consumers to your competitors. It’s all about emotions and perceptions—two powerful drivers of decision-making.

The Role of AI and Machine Learning in Market Sentiment Analysis

With the rise of AI and machine learning, sentiment analysis has become faster and more accurate. These tools can sift through massive amounts of data, detecting patterns and predicting future trends with precision. They’re like having a crystal ball for market sentiment.

Market Sentiment Data in Crisis Management

In times of crisis, market sentiment data is invaluable. By analyzing shifts in sentiment, companies can detect early warning signs and manage public perception before it spirals out of control.

How Market Sentiment Data Affects Brand Perception

Your brand’s reputation is built on sentiment. If people trust and like your brand, they’ll be loyal customers. But negative sentiment can damage your brand’s image, so it’s crucial to address it quickly.

Ethics of Using Market Sentiment Data

With great data comes great responsibility. Companies must be mindful of privacy concerns and ensure that sentiment data isn’t manipulated to mislead the public.

Case Studies

Let’s look at some real-world examples:

- Tesla uses sentiment data to gauge public perception of its innovative products.

- Apple monitors sentiment to track the reception of its product launches and updates.

These companies rely on sentiment data to stay ahead of the curve and keep their brands strong.

Conclusion

In a world where opinions shape markets, understanding market sentiment data is more important than ever. Whether you’re a business leader looking to tap into consumer behavior or an investor trying to predict stock movements, sentiment data can provide the insights you need to succeed. With the right tools, you can analyze and leverage this data to make smarter, more informed decisions.

If you’re ready to take your business to the next level and harness the power of market sentiment analysis, request a demo from AIM Technologies today. Discover how our advanced AI-driven tools can help you gain actionable insights and stay ahead in an ever-changing market.